are political donations tax deductible uk

Subscriptions for general charitable purposes and those to for example political parties are almost always made wholly or partly for non-trade purposes and should not be allowed as deductions in calculating the profits of a trade. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

How Anyone Can Get A 2021 Tax Deduction Charitable Donations

Helping business owners for over 15 years.

. In terms of deductibility for trade purposes such contributions cannot satisfy the wholly and exclusively test. As per your preferences and claim income tax deductions for the same when making donations to political parties. Whether a limited company can make a political donation is firstly a question of company law.

Taxation is very clear about it since contributions to politicians or political parties cannot be deducted from your income. This is called tax relief. This includes paying a membership subscription to a registered political party.

Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. While charitable donations are generally. In a donation to a political party under section 80GGB the Company can claim 100 reimbursement.

Reuters is the first to measure the loophole which offers political parties and in some cases individual politicians or their families an unintended gift from the taxpayer. Is Donation To Political Party Tax Deductible. Businesses cannot claim deductions for contributions and gifts to political parties members and candidates including payments incurred in deriving assessable income.

If a donor makes money as salary or dividend and then donates it they have to pay income tax. Donations to political parties are also exempt from tax deductions. Think about whether political contributions gifts and volunteers are tax deductible if you are planning to make contributions to a political campaign.

Political donations made by individuals are not tax-deductible in Britain. To claim these amounts save all official tax donation receipts for. The Companies Act 2006 forbids certain specified political donations and expenditure without prior approval by the shareholders.

What political donations are tax-deductible. How this works depends on whether you. Millions of pounds in donations to political parties a Reuters analysis has found.

Donations to political parties are also non-tax-deductible expenses. Subscriptions for general charitable purposes and those to for example political parties are almost always made wholly or partly for non-trade purposes and should not be. Contributions donations or payments made for political candidates cannot be deducted from your taxable income.

If companies fall foul of this then the directors can be compelled to repay the amount themselves. Additionally individuals and businesses can donate to nonprofit schools hospitals and other organizations and receive deductions. The tax goes to you or the charity.

Nevertheless a large number of donations to UK political parties are made by companies and benefit from deductibility from corporation tax. Donations by individuals to charity or to community amateur sports clubs CASCs are tax free. Are political contributions tax-deductible for my business.

As Gift Aid is only offered to registered government-approved charities it stops corporations offsetting costs through privately owned non-profit organisations. Are political party donations tax deductible UK. There is no way for your tax deductions to take effect from contributions to.

Individuals may donate up to 2800 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee. Your political gifts or contributions need to be made in a personal capacity to be tax deductible. But I thought donations were tax-deductible.

Political party and independent candidate donations In some circumstances your gifts and donations to registered political parties or independent candidates may be claimed as a deduction. Contributions of 500 or less are somewhat confusingly not considered to be donations. Although political contributions are not tax-deductible money or property given to churches temples mosques and other religious organizations is tax-deductible.

You can receive up to 75 percent of your first 400 of donation as credit followed by 50 percent of any amount between 400 and 750 and 333 percent of amounts over 750. Donations to charity made by businesses that are claimed as a deduction against trading income must be made wholly and exclusively for the purposes of the business in order for a. Donations are a tax-deductible expense but they must be made via Gift Aid.

As Gift Aid is only offered to registered government-approved charities it stops corporations offsetting costs through privately owned non-profit organisations. Political donations made by individuals are not tax-deductible in Britain. This means political parties are not required to keep records of the names and addresses of people.

It is almost impossible for contributions to political parties to constitute tax deductible items. This paper argues however that such deductions rarely satisfy the wholly and exclusively test for duality of purpose. The maximum contribution amount you can claim is 1275 which translates into a maximum credit of 650.

Donations are a tax-deductible expense but only if they are contributed via Gift Aid. Your business cant deduct political contributions donations or payments on your tax return. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Nonprofit Tax Programs Around The World Eu Uk Us

Donate Crypto And Lower Your Tax Bill Koinly

Tax Deductible Donations These Are The Conditions

Tax Deductible Donations Can You Write Off Charitable Donations

Are My Donations Tax Deductible Actblue Support

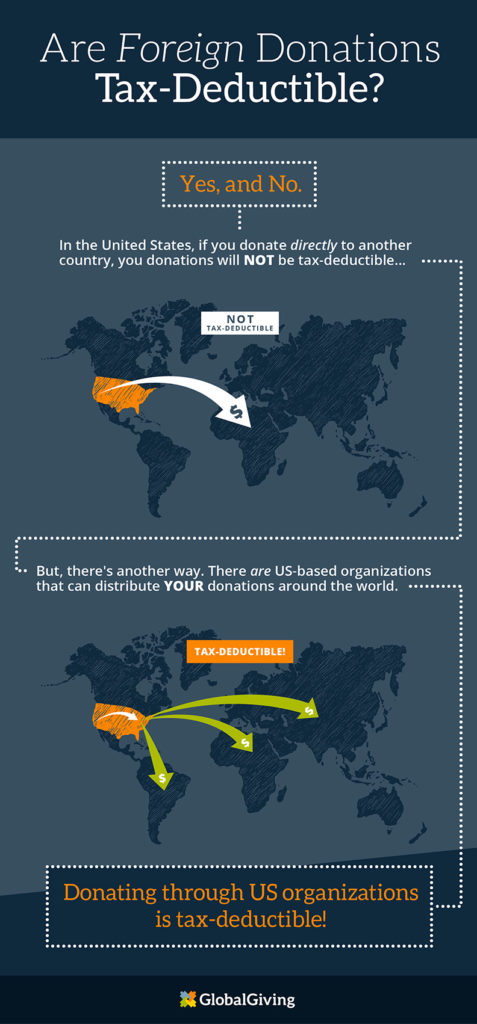

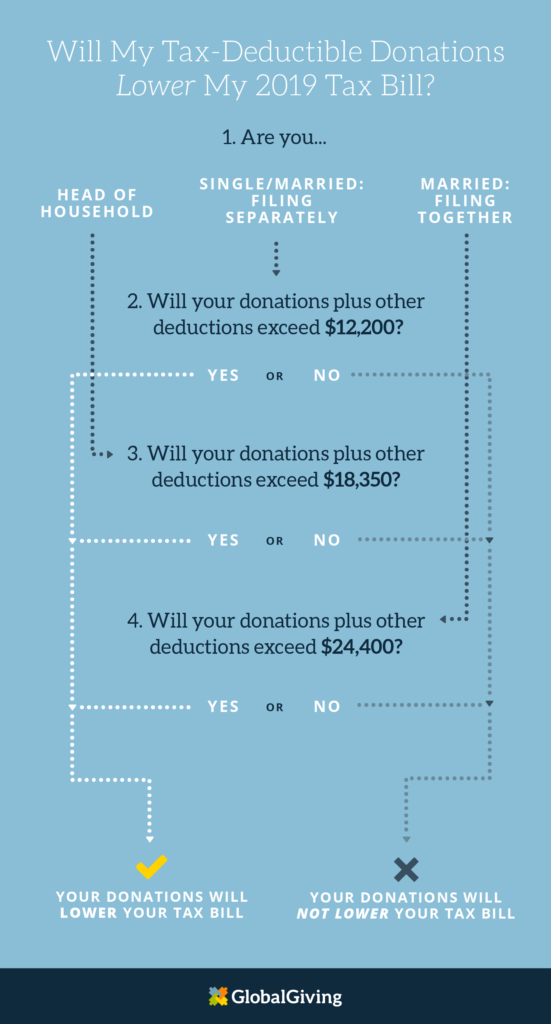

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Donating Pre Ipo Shares To A Donor Advised Fund Nptrust

Are My Donations Tax Deductible Actblue Support

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

How Much Should You Donate To Charity District Capital

Understanding Tax Deductions For Charitable Donations

Inside The U K S Pandemic Spending Waste Negligence And Cronyism The New York Times

Tax Deductible Donations Can You Write Off Charitable Donations